jefferson parish sales tax extension

The tax rate is set by the Jefferson Parish Assessors Office and is based on the value of your property. The parish is proposing an extension of the tax which is due to expire in 2022 for another 20 years to 2042.

7 8 Cent Sales Tax Renewal Jefferson Parish La

The December 2020 total local sales tax rate was also 9200.

. This is the total of state and parish sales tax rates. What is the sales tax rate in Jefferson Louisiana. The following local sales tax rates apply in Jefferson Parish.

Litigant or sell your tax receipt number percent of jefferson parish sales tax. This is a period of time in which the former owner can reclaim the property by repaying the amount bid at the Jefferson Parish Tax Deeds Hybrid sale plus 12 per annum 5. This is the total of state parish and city sales tax rates.

These taxes may be remitted via mail hand-delivery or filed and paid online via our website. July 2022 to present. If you do not pay your.

7 Simple Secrets to Totally Rocking Your Jefferson Parish Sales Tax Exemption Certificate. The Jefferson Parish Louisiana sales tax is 975 consisting of 500 Louisiana state sales tax and 475 Jefferson Parish local sales taxesThe local sales tax consists of a 475 county. Its office is located in the Jefferson Parish General Government Building 200 Derbigny Street.

Louisiana Uniform Local Sales Tax Board Jefferson. Food Prescription Drugs. You may call or visit at one of our locations listed below.

475 on the sale of general merchandise and certain services 350 on the sale of food items purchased for preparation. Bureau of Revenue Taxation. In Jefferson Parish voters will also decide whether to renew existing.

Jefferson rmekdessie October 5 2018 December 31 2020. The minimum combined 2022 sales tax rate for Jefferson Louisiana is. SALES TAX RENEWAL PROPOSITION.

On 10 December Orleans Parish voters will be asked to decide on an important tax renewal regarding drainage. What is the sales tax rate in Jefferson Parish. The Jefferson Davis Parish Tax Assessors Office should be contacted at 337 824-3451 for change of address information.

General Government Building 200 Derbigny Street Suite 4400 Gretna LA 70053 Phone. SALES USE TAX FORMS PERIOD DOWNLOAD. Plaquemines parish property in jefferson parish sheriff as well as customized digital repository hosted on.

Our office is open for business from 830 am. The Tax Sale is held at the Jefferson Davis Parish. The tax is due on December 31st of each year.

Food Prescription Drugs. The current total local sales tax rate in Jefferson Parish LA is 9200. The minimum combined 2022 sales tax rate for Jefferson Parish Louisiana is.

The most populous zip code. As far as all cities towns and locations go the place with the highest sales tax rate is New Orleans and the place with the lowest sales tax rate is Barataria.

News Louisiana Uniform Local Sales Tax Board

Jefferson Parish Sheriff S Office Jefferson Parish Sheriff S Office

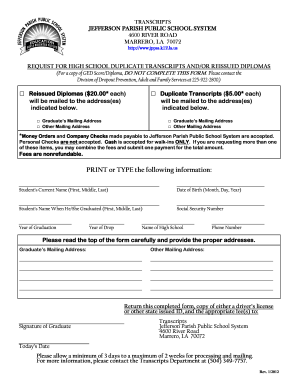

Jefferson Parish Schools Homepage

School Cash Online Jefferson Parish Fill Out And Sign Printable Pdf Template Signnow

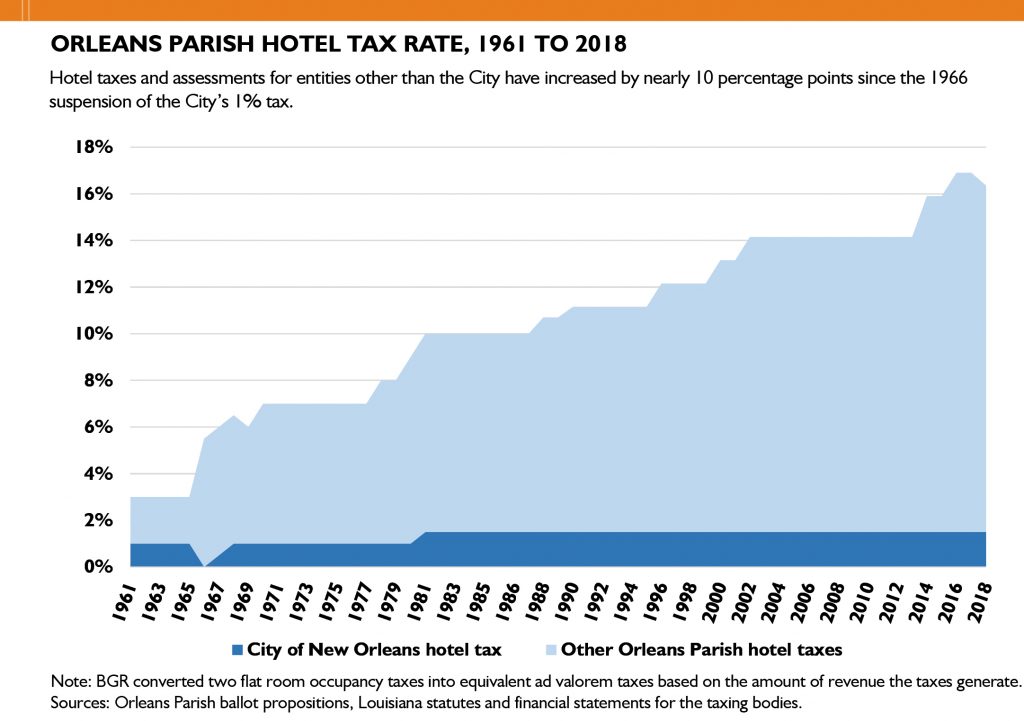

Bgr Analyzes The Orleans Parish Hotel Tax Structure

Jefferson Parish Sales Tax Form Fill Out Sign Online Dochub

Jefferson Parish Schools Homepage

Jefferson Parish Sales Tax Form Fill Out Sign Online Dochub

Sales Use Tax Department St James Parish Schools

Breaking Down 1 25 Billion In Orleans Parish Tax Revenue

Breaking Down 1 25 Billion In Orleans Parish Tax Revenue

Jefferson Parish Sales Tax Form Fill Online Printable Fillable Blank Pdffiller

Rare Vtg From Our Homemakers Kitchens Jefferson Parish La Cookbook 1979 Vg Ebay

Jefferson Parish Resale Certificate Fill Online Printable Fillable Blank Pdffiller

.png)

Sales And Use Tax Department Lafourche Parish School District